Headlines

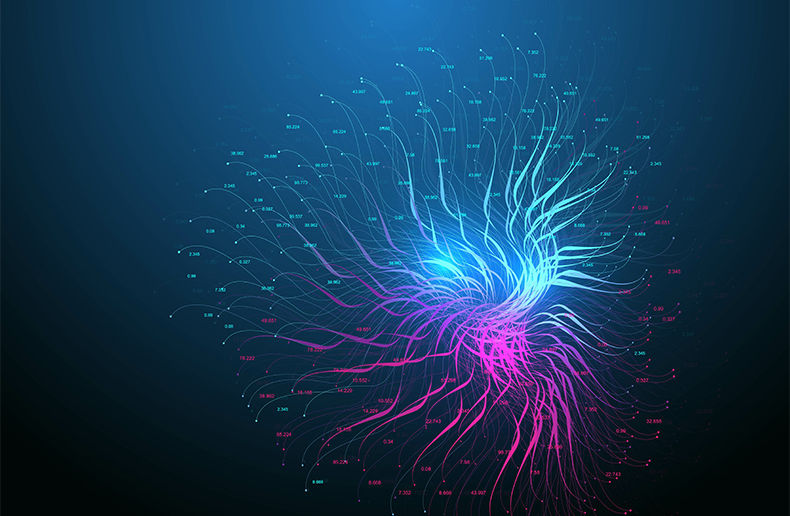

Insurers pushing their limits in accelerated underwriting

Data analytics allow insurers to provide coverage more quickly and for larger amounts.

Advertisement

Advertisement

Life Insurance

P&C

Investment

Entrepreneurship

Advertisement

Health

Society